| Home | Terms of Use | Privacy Policy | About Us | Contact Us |Ĭopyright © 2005-12 All rights reserved. Learn the skills a designer, CADD operator, architect or engineer needs for a successful career. Get hands-on training in Collin College’s intensive CADD program. Enter the street number, followed by a space and the street name. A degree in Computer-Aided Drafting and Design (CADD) can provide you with both an educational foundation in computer-aided design and insight into current industry practices. Enter the street number followed by a space and the street name.

#Collin county cad software#

If you do not have Adobe Acrobat Reader software on your computer you may download a free copy below. Enter owner's last name followed by a space and the first name or initial.

#Collin county cad pdf#

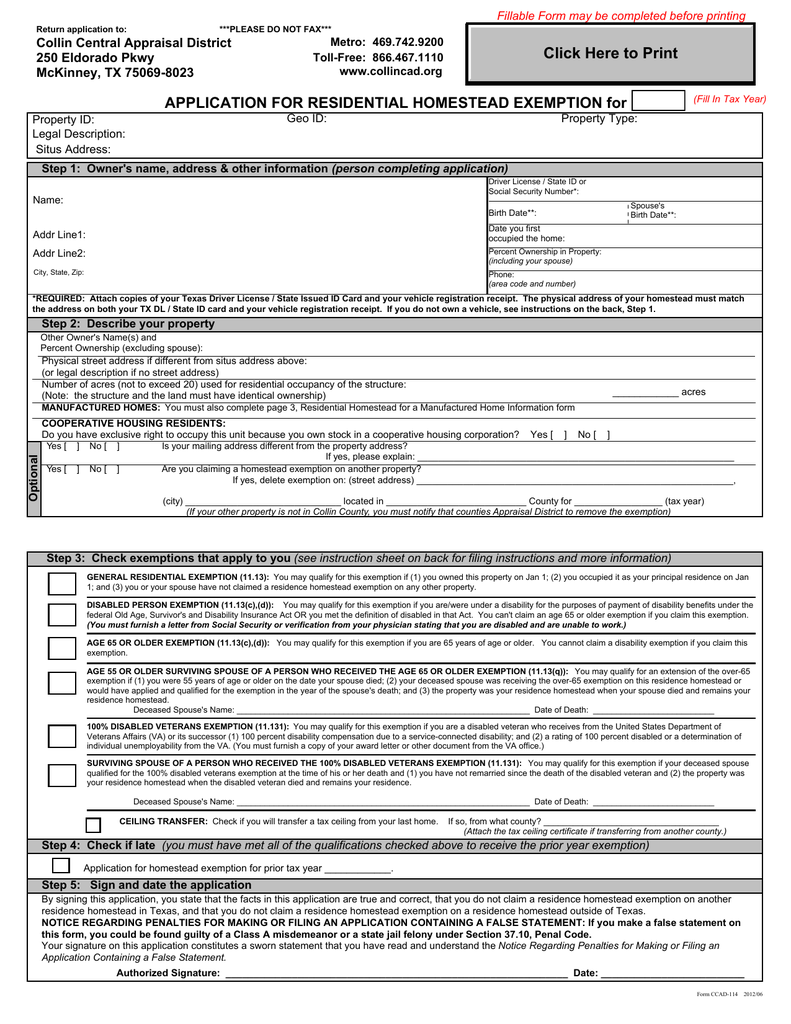

The above Collin County appraisal district form is in Adobe Acrobat PDF format. The typical delinquency date is February 1. You may file a late Collin County homestead exemption application if you file it no later than one year after the date taxes become delinquent. Interest is imposed at the statutory rate of 1 on the 1st day of delinquency, and will increase 1. Penalty is imposed at the statutory rate of 6 on the first day of the delinquency month, and will increase 1 on the first day each month thereafter, reaching 12 maximum by July 1. City/Town Boundary Maps Allen Anna Blue Ridge Celina. Collin County Property Taxes become delinquent on February 1.

#Collin county cad code#

Users can easily view the boundaries of each Zip Code and the state as a whole. The typical deadline for filing a Collin County homestead exemption application is between January 1 and April 30. This page shows a Google Map with an overlay of Zip Codes for Collin County in the state of Texas. Homeowners in military service or in a facility providing services related to health, infirmity or aging may exceed the two year period. If you temporarily move away from your home, you still can qualify for a Collin County homestead exemption if you do not establish another principal residence and you intend to return in a period of less than two years. Collin County Community College District (locally referred to as Collin County Community College, Collin College, Collin, CCCCD or CCCC ) is a public higher education institution that resides in McKinney, Texas. Collin County Moms is a locally-focused parenting resource for moms and families. You or your spouse have not claimed a residence homestead exemption on any other property Collin County Community College District. You occupied it as your principal residence on January 1st covers the Collin County Appraisal District.

You qualify for a Collin County appraisal district homestead exemption if: You can browse through all 3 jobs Collin Central Appraisal District has to offer. The First Collin County Appraisal District Reference and Guide to Lower Taxes | Home | Basics | Questions | Tax Rates | Calculator | Personal Property | Exemptions | Forms | Calendar | Contact CCAD | Protest |

0 kommentar(er)

0 kommentar(er)